Should you’re wrestling with persistent bank card debt, a debt consolidation mortgage may very well be your ticket to monetary reduction. Uncover the highest 10 lenders for 2024 on this expertly curated listing, every providing distinctive advantages that can assist you regain management of your funds.

Have you ever been struggling to take care of bank card debt that by no means appears to go away? In that case, a debt consolidation mortgage can provide a manner out.

It received’t make your debt go away, however it should assist it change into extra manageable. And by organising the correct mortgage, you may be debt-free in just a few quick years.

That will help you in your seek for the correct mortgage, we ready this information on the ten greatest consolidation loans for 2024.

The desk under offers a abstract of the primary options supplied by every lender. You’ll be able to then scroll down and skim our abstract evaluations with extra data on every lender that will curiosity you.

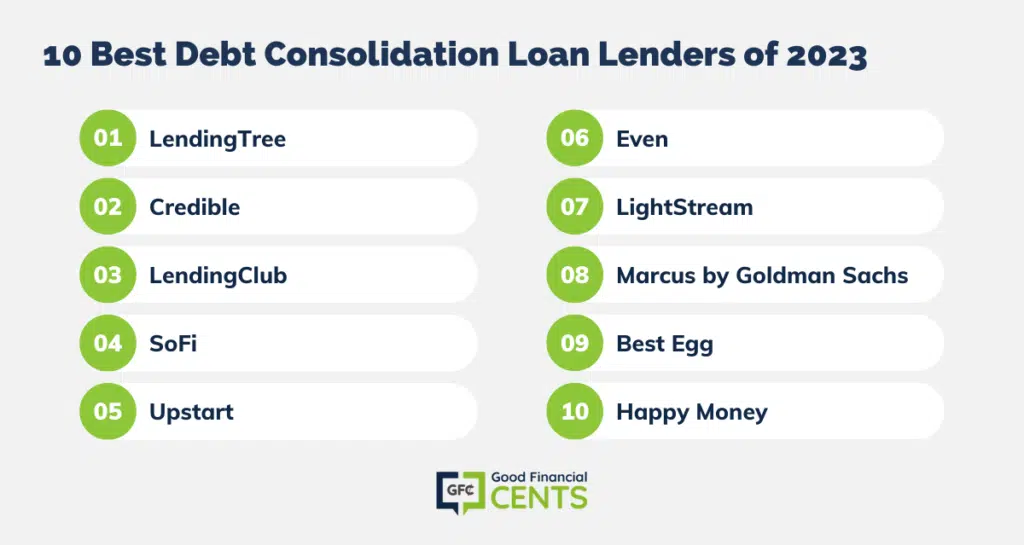

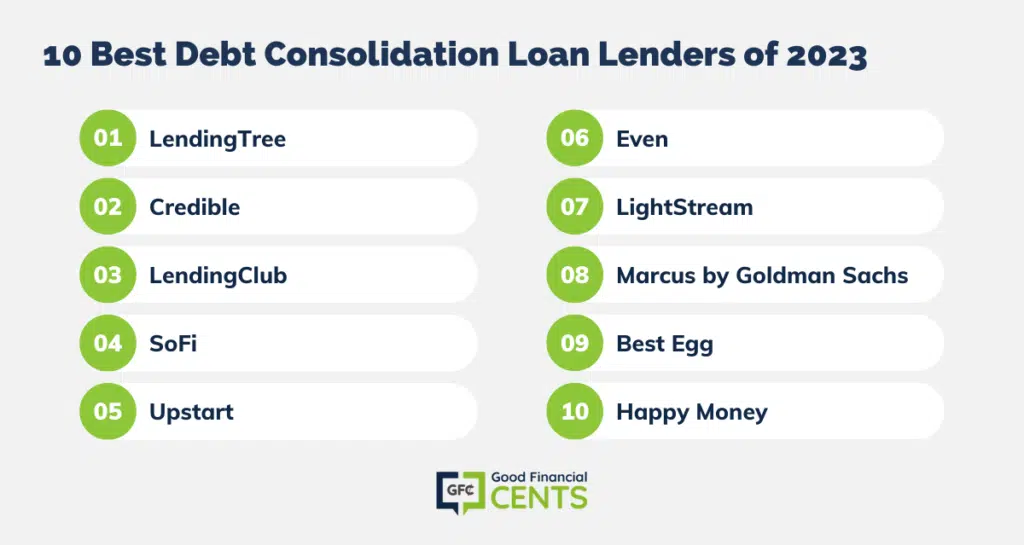

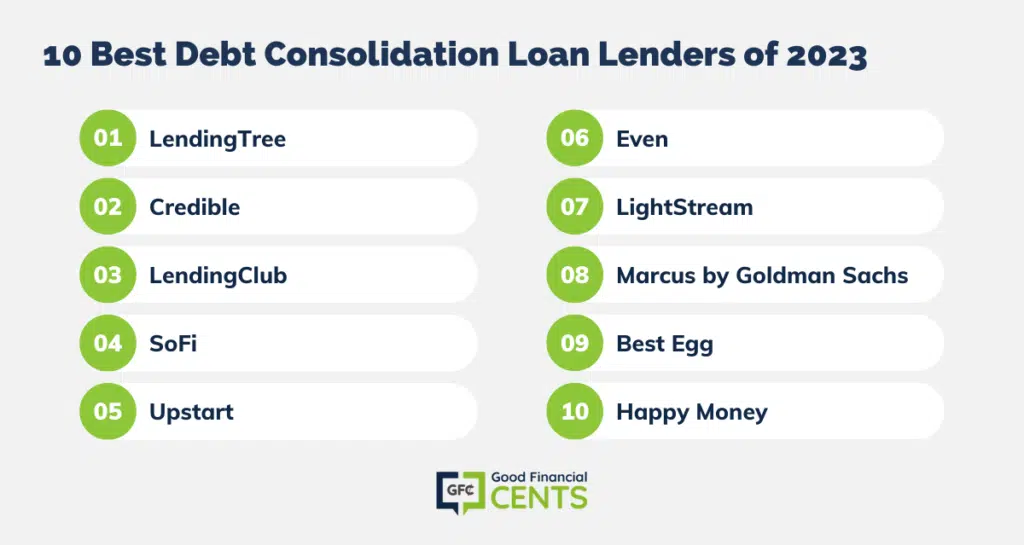

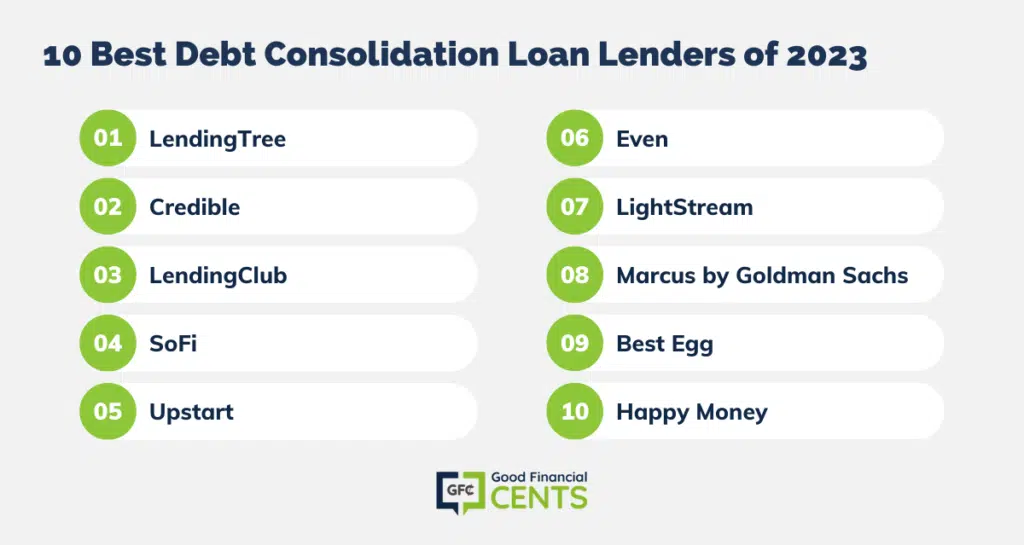

Right here is our listing of the ten greatest debt consolidation mortgage lenders of 2024:

Beneath are our abstract evaluations for every.

Minimal/Most Mortgage Quantity: $1,000 to $100,000

Curiosity Fee Vary: 4.37% to 35.99% APR

Charges: 0% to 10%

Mortgage Phrases: 24 to 144 months

Minimal Credit score Rating: 585

LendingTree is a web-based mortgage market providing mortgages, auto loans, and bank cards. For debt consolidation, you may apply for a private mortgage from $1,000 to $100,000, with phrases starting from two years to 12 years.

The massive benefit of LendingTree is which you can get mortgage quotes from no less than 11 private mortgage lenders on the similar time. Taking part lenders are a number of the greatest within the business, and even embody a number of the lenders on this information.

Minimal/Most Mortgage Quantity: $600 to $100,000

Curiosity Fee Vary: 5.40% to 35.99% APR

Charges: Varies by lender

Mortgage Phrases: 24 to 84 months

Minimal Credit score Rating: 585

Very like LendingTree, Credible is a web-based mortgage market. Not solely do they provide private loans, mortgages, and bank cards, but additionally pupil loans and pupil mortgage refinancing.

Private loans can be found for debt consolidation in quantities as much as $100,000 and with phrases so long as 84 months. Credible advertises the bottom rates of interest of all lenders on this listing. A complete of 17 lenders providing private loans take part on the platform.

Credible has a particular provide for private mortgage candidates; if they will’t discover you one of the best private mortgage charge obtainable, they’ll provide you with $200.

Minimal/Most Mortgage Quantity: $1,000 to $40,000

Curiosity Fee Vary: 7.04% to 35.89% APR

Charges: 3% to six%

Mortgage Phrases: 36 or 60 months

Minimal Credit score Rating: Not disclosed

LendingClub is a peer-to-peer mortgage platform that brings collectively debtors making use of for loans which might be funded by buyers collaborating within the platform.

You’ll be able to apply for as much as $40,000, with a mortgage time period of both three years or 5 years. All loans are fixed-rate and shall be totally repaid on the finish of the time period.

LendingClub is among the greatest lenders within the private mortgage area, having supplied greater than $60 billion in financing. It additionally offers enterprise loans, medical loans (affected person options), and auto refinancing loans.

Minimal/Most Mortgage Quantity: $5,000 to $100,000

Curiosity Fee Vary: 5.74% to twenty.28% APR

Charges: None

Mortgage Phrases: 24 to 84 months

Minimal Credit score Rating: 680

SoFi started as a service offering pupil mortgage refinancing. However it has since expanded, and now offers complete monetary providers that embody investments, banking, bank cards, insurance coverage, and even credit score scores and budgeting. The platform boasts greater than 3.5 million members.

SoFi private loans are designed primarily for these with good or glorious credit score. Should you qualify, you may borrow as much as $100,000 for so long as 84 months. And you are able to do all of it with no mortgage charges!

Minimal/Most Mortgage Quantity: $1,000 to $50,000

Curiosity Fee Vary: 3.09% to 35.99% APR

Charges: 0% to eight%

Mortgage Phrases: 36 or 60 months

Minimal Credit score Rating: 600

Upstart gives a number of totally different mortgage choices, together with auto mortgage refinances, medical loans, residence enchancment loans, and private loans for debt consolidation.

You’ll be able to borrow as much as $50,000 with charges beginning as little as 3.09% APR (Annual Proportion Fee). The minimal credit score rating at 600, will accommodate debtors with common or truthful credit score.

Like many different private mortgage lenders, mortgage phrases are available two sizes: 36 months and 60 months. This lender additionally has doubtlessly steep mortgage charges, with an origination charge as excessive as 8%.

That might imply a $4,000 charge on a $50,000 mortgage, supplying you with web proceeds of solely $46,000.

Minimal/Most Mortgage Quantity: $1,000 to $100,000

Curiosity Fee Vary: 4.99% to 35.99% APR

Charges: Varies by lender

Mortgage Phrases: 24 to 84 months

Minimal Credit score Rating: Varies by lender

Even is a monetary providers platform that provides private loans for nearly any objective. You’ll be able to borrow as much as $100,000, with charges beginning at 4.99% APR and phrases starting from 24 to 84 months.

Like a number of the different lenders on this information, Even is a web-based mortgage market. By finishing a single on-line software, you’ll get charge quotes from a number of lenders. This provides you a chance to decide on the mortgage that can work greatest for you.

Minimal/Most Mortgage Quantity: $5,000 to $100,000

Curiosity Fee Vary: 2.99% to 19.99% APR

Charges: None

Mortgage Phrases: 24 to 144 months

Minimal Credit score Rating: Excessive, however not specified

LightStream is the web private mortgage program for Truist Financial institution (previously SunTrust). The corporate is a direct lender, providing private loans as much as $100,000 for nearly any objective. They cost low charges, with phrases so long as 144 months.

LightStream will work greatest for these with good or glorious credit score, as their credit score necessities are steep.

Not solely do they require a superb cost historical past with no delinquencies, but additionally a confirmed means to economize within the type of financial institution deposits, shares, actual property, retirement, and different property, in addition to a stable credit score historical past.

Minimal/Most Mortgage Quantity: $3,500 to $40,000

Curiosity Fee Vary: 6.99% to 19.99% APR

Charges: None

Mortgage Phrases: 36 to 72 months

Minimal Credit score Rating: 660

Marcus by Goldman Sachs is a direct lender that not solely gives private loans but additionally financial savings accounts, investments, and bank cards.

Private loans can be found in quantities as much as $40,000, with charges beginning as little as 6.99% APR. Not solely do they cost no charges in reference to their private loans, however there are additionally no late charges.

The minimal credit score rating requirement of 660 means you will have no less than common credit score to qualify. This isn’t a lender for customers with truthful or poor credit score.

Minimal/Most Mortgage Quantity: $2,000 to $50,000

Curiosity Fee Vary: 5.99% to 35.99% APR

Charges: 0.99% to five.99%

Mortgage Phrases: 36 or 60 months

Minimal Credit score Rating: 600

Whereas Best Egg offers private loans for debt consolidation, the corporate is now increasing into providing bank cards.

Private loans can be found in quantities as much as $50,000, with rates of interest beginning as little as 5.99% APR, when it comes to 36 or 60 months. The corporate has already supplied greater than $10 billion in private loans to customers.

Finest Egg is a direct lender, with loans supplied by New Jersey-based Cross River Financial institution. Although the minimal credit score rating requirement is 600, the corporate requires a minimal particular person earnings of $100,000.

Minimal/Most Mortgage Quantity: $5,000 to $40,000

Curiosity Fee Vary: 5.99% to 24.99% APR

Charges: 0% to five%

Mortgage Phrases: 24 or 60 months

Minimal Credit score Rating: 640

Joyful Cash is a direct on-line lender offering private loans. Nonetheless, these loans can be found just for debt consolidation. They won’t be obtainable for main bills, like a marriage or an upcoming trip.

Loans can be found in quantities as much as $40,000, with charges as little as 5.99% APR. You’ll have a alternative on the mortgage time period of both 24 or 60 months. However anticipate to pay an origination charge as excessive as 5%.

In the end, debt consolidation is each a manner to get out of debt and a possibility to decrease your whole month-to-month funds.

Debt consolidation doesn’t decrease the whole quantity of current debt you owe or your total credit score utilization. As a substitute, it rolls a number of loans into one, with a single mortgage steadiness and one month-to-month cost.

Simply by consolidating a number of loans into one single installment mortgage, you could possibly profit from a decrease rate of interest or extra manageable reimbursement phrases.

That may translate right into a decrease month-to-month cost. And since debt consolidation loans are usually structured with a hard and fast charge and time period, the consolidated debt shall be totally repaid on the finish of the time period.

This may be particularly useful with high-interest debt, similar to that of bank cards, or for unsecured debt.

Essentially the most primary purpose why it’s so laborious to get out of bank card debt is due to its revolving nature. As you pay down, the month-to-month cost drops.

And once you use the cardboard for extra purchases, the steadiness will increase. That additionally raises your bank card cost.

However by paying off the bank card debt with a consolidation mortgage, the mortgage — which incorporates your bank card debt — shall be totally repaid after simply three to 5 years.

Should you ever marvel if I ought to consolidate my debt, crunch the numbers and see the way it can work together with your bank card debt.

Debt consolidation loans are basically unsecured loans that supply a hard and fast rate of interest and time period. The mixture makes it potential to get rid of the consolidated debt inside a really particular timeframe.

Debt consolidation loans can vary anyplace from 24 months to so long as 84 months, although it’s potential to increase that out to 144 months (12 years) via a lender like LightStream.

Debt consolidation loans are usually supplied within the type of private loans. These work particularly effectively for debt consolidation since they can be utilized for nearly any objective, from medical payments to bank card consolidation.

Whereas most normally deposit the mortgage funds into the borrower’s checking account immediately, some pay the cash out on to the lenders.

The rate of interest you’ll pay on a debt consolidation mortgage will rely upon a mixture of components, together with your credit score rating, your debt-to-income ratio, and the quantity borrowed.

Debt consolidation is among the most easy methods to enhance debt administration abilities. At a minimal, it allows you to cut back the variety of month-to-month mortgage funds. That by itself can provide you higher management over your money owed.

Sure, on each counts! Let’s take a look at credit score scores first.

One of many components credit score bureaus think about when calculating your credit score rating is the variety of loans and credit score traces with excellent balances.

If you use a debt consolidation mortgage to roll a number of money owed right into a single mortgage, the variety of excellent money owed declines instantly.

One thing else occurs as effectively, no less than once you’re consolidating bank cards. The credit score bureaus think about installment debt, which is often what debt consolidation loans are, to be much less dangerous than revolving debt.

In actual fact, revolving debt is taken into account the riskiest debt of all. By eliminating it via a debt consolidation mortgage, you’ll have one other issue working in your favor in direction of bettering a bad credit report rating and rising your total creditworthiness.

Many individuals who do debt consolidation loans expertise an instantaneous enhance of their credit score scores for the explanations described above, even regardless of the drop from the credit score inquiry your lender makes.

It can assist to know what a superb credit score rating is so you may observe any constructive modifications in your rating after taking the mortgage.

A debt consolidation mortgage also can have an effect on your month-to-month funds. If the month-to-month cost on the consolidation mortgage is decrease than the whole of the funds on the loans you’re paying off, your web month-to-month cost will drop.

Pretty much as good as a debt consolidation mortgage sounds, you will have to keep away from debt consolidation pitfalls.

Most likely the commonest is once you arrange a debt consolidation mortgage after which proceed borrowing more cash.

That’s a straightforward lure to fall into as a result of the debt consolidation mortgage can look like a get-out-of-jail-free card. However relaxation assured, it’s not. Should you proceed with this sample, you’ll find yourself with a bunch of latest debt on prime of your debt consolidation mortgage.

One other potential pitfall shouldn’t be getting full management of your finances after a debt consolidation mortgage.

You must consider a debt consolidation mortgage as a monetary instrument designed that can assist you take care of previous monetary errors, like overspending.

However if you happen to proceed to overspend, which can possible end in new debt, the debt consolidation effort shall be a failure.

Methods to get a private mortgage accepted includes a sequence of steps. These will focus on your credit score rating, debt-to-income ratio, and the sum of money you borrow.

Many lenders will assign you a credit score grade based mostly on a mix of the three. The upper your grade, the decrease the speed you’ll pay, and vice versa.

Your debt-to-income ratio, which is solely your month-to-month recurring money owed divided by your steady month-to-month earnings, signifies how effectively the brand new mortgage will match inside your finances.

The decrease your debt ratio—say, lower than 30%—the higher your mortgage grade shall be. A excessive ratio (exceeding 40%) will point out the next threat issue, contributing to a decrease grade.

The identical is true with the mortgage quantity you borrow. A $50,000 mortgage shall be thought-about a much bigger threat to the lender than a $15,000 mortgage. Your mortgage grade could also be decrease if you happen to take a bigger mortgage quantity.

Most necessary is your credit score rating. As you may see from the lenders included on this information, a credit score rating of no less than 680 will get you a decrease rate of interest.

Beneath 680, you will note you paying on the higher finish of the rate of interest vary. For that reason, it will likely be necessary to enhance your credit score rating, even to use for a debt consolidation mortgage.

Get a replica of your credit score report and focus on fixing errors in your credit score report.

But when your credit score rating is way under 650, it could be time to look into utilizing the providers of top-of-the-line credit score restore providers. It may imply the distinction between a ten% rate of interest and 20% or 30%.

Some lenders might will let you entry a greater charge or up your potential eligibility by taking out the mortgage with a co-signer with higher credit score.

To provide you with this listing of the ten greatest debt consolidation loans for 2024, we used the next standards:

Above and past these 5 components, we additionally thought-about firm repute, recognition with customers, and any particular options or further providers every gives.

Let’s recap the ten greatest debt consolidation loans for 2024:

Should you’re drowning in bank card debt, a debt consolidation mortgage stands out as the proper technique for you. It’s the proper manner so that you can get off the revolving debt treadmill.

Have you ever been struggling to take care of bank card debt that by no means appears to go away? In that case, a debt consolidation mortgage can provide a manner out.

It received’t make your debt go away, however it should assist it change into extra manageable. And by organising the correct mortgage, you may be debt-free in just a few quick years.

That will help you in your seek for the correct mortgage, we ready this information on the ten greatest consolidation loans for 2024.

The desk under offers a abstract of the primary options supplied by every lender. You’ll be able to then scroll down and skim our abstract evaluations with extra data on every lender that will curiosity you.

Our Picks for Finest Debt Consolidation Loans

Right here is our listing of the ten greatest debt consolidation mortgage lenders of 2024:

- LendingTree: Finest Lender Choice

- LendingClub: Finest for Peer-to-Peer Loans

- SoFi: Finest for Complete Monetary Companies

- Upstart: Finest for Truthful Credit score

- Even: Finest for Excessive Mortgage Quantities

- LightStream: Finest for Good to Wonderful Credit score

- Marcus by Goldman Sachs: Finest for Investing

- Finest Egg: Finest for Good Buyer Service

- Joyful Cash (previously Payoff): Finest for Excessive DTI Ratios

Beneath are our abstract evaluations for every.

Finest Debt Consolidation Loans – Firm Evaluations

Minimal/Most Mortgage Quantity: $1,000 to $100,000

Curiosity Fee Vary: 4.37% to 35.99% APR

Charges: 0% to 10%

Mortgage Phrases: 24 to 144 months

Minimal Credit score Rating: 585

LendingTree is a web-based mortgage market providing mortgages, auto loans, and bank cards. For debt consolidation, you may apply for a private mortgage from $1,000 to $100,000, with phrases starting from two years to 12 years.

The massive benefit of LendingTree is which you can get mortgage quotes from no less than 11 private mortgage lenders on the similar time. Taking part lenders are a number of the greatest within the business, and even embody a number of the lenders on this information.

Minimal/Most Mortgage Quantity: $600 to $100,000

Curiosity Fee Vary: 5.40% to 35.99% APR

Charges: Varies by lender

Mortgage Phrases: 24 to 84 months

Minimal Credit score Rating: 585

Very like LendingTree, Credible is a web-based mortgage market. Not solely do they provide private loans, mortgages, and bank cards, but additionally pupil loans and pupil mortgage refinancing.

Private loans can be found for debt consolidation in quantities as much as $100,000 and with phrases so long as 84 months. Credible advertises the bottom rates of interest of all lenders on this listing. A complete of 17 lenders providing private loans take part on the platform.

Credible has a particular provide for private mortgage candidates; if they will’t discover you one of the best private mortgage charge obtainable, they’ll provide you with $200.

Minimal/Most Mortgage Quantity: $1,000 to $40,000

Curiosity Fee Vary: 7.04% to 35.89% APR

Charges: 3% to six%

Mortgage Phrases: 36 or 60 months

Minimal Credit score Rating: Not disclosed

LendingClub is a peer-to-peer mortgage platform that brings collectively debtors making use of for loans which might be funded by buyers collaborating within the platform.

You’ll be able to apply for as much as $40,000, with a mortgage time period of both three years or 5 years. All loans are fixed-rate and shall be totally repaid on the finish of the time period.

LendingClub is among the greatest lenders within the private mortgage area, having supplied greater than $60 billion in financing. It additionally offers enterprise loans, medical loans (affected person options), and auto refinancing loans.

Minimal/Most Mortgage Quantity: $5,000 to $100,000

Curiosity Fee Vary: 5.74% to twenty.28% APR

Charges: None

Mortgage Phrases: 24 to 84 months

Minimal Credit score Rating: 680

SoFi started as a service offering pupil mortgage refinancing. However it has since expanded, and now offers complete monetary providers that embody investments, banking, bank cards, insurance coverage, and even credit score scores and budgeting. The platform boasts greater than 3.5 million members.

SoFi private loans are designed primarily for these with good or glorious credit score. Should you qualify, you may borrow as much as $100,000 for so long as 84 months. And you are able to do all of it with no mortgage charges!

Minimal/Most Mortgage Quantity: $1,000 to $50,000

Curiosity Fee Vary: 3.09% to 35.99% APR

Charges: 0% to eight%

Mortgage Phrases: 36 or 60 months

Minimal Credit score Rating: 600

Upstart gives a number of totally different mortgage choices, together with auto mortgage refinances, medical loans, residence enchancment loans, and private loans for debt consolidation.

You’ll be able to borrow as much as $50,000 with charges beginning as little as 3.09% APR (Annual Proportion Fee). The minimal credit score rating at 600, will accommodate debtors with common or truthful credit score.

Like many different private mortgage lenders, mortgage phrases are available two sizes: 36 months and 60 months. This lender additionally has doubtlessly steep mortgage charges, with an origination charge as excessive as 8%.

That might imply a $4,000 charge on a $50,000 mortgage, supplying you with web proceeds of solely $46,000.

Minimal/Most Mortgage Quantity: $1,000 to $100,000

Curiosity Fee Vary: 4.99% to 35.99% APR

Charges: Varies by lender

Mortgage Phrases: 24 to 84 months

Minimal Credit score Rating: Varies by lender

Even is a monetary providers platform that provides private loans for nearly any objective. You’ll be able to borrow as much as $100,000, with charges beginning at 4.99% APR and phrases starting from 24 to 84 months.

Like a number of the different lenders on this information, Even is a web-based mortgage market. By finishing a single on-line software, you’ll get charge quotes from a number of lenders. This provides you a chance to decide on the mortgage that can work greatest for you.

Minimal/Most Mortgage Quantity: $5,000 to $100,000

Curiosity Fee Vary: 2.99% to 19.99% APR

Charges: None

Mortgage Phrases: 24 to 144 months

Minimal Credit score Rating: Excessive, however not specified

LightStream is the web private mortgage program for Truist Financial institution (previously SunTrust). The corporate is a direct lender, providing private loans as much as $100,000 for nearly any objective. They cost low charges, with phrases so long as 144 months.

LightStream will work greatest for these with good or glorious credit score, as their credit score necessities are steep.

Not solely do they require a superb cost historical past with no delinquencies, but additionally a confirmed means to economize within the type of financial institution deposits, shares, actual property, retirement, and different property, in addition to a stable credit score historical past.

Minimal/Most Mortgage Quantity: $3,500 to $40,000

Curiosity Fee Vary: 6.99% to 19.99% APR

Charges: None

Mortgage Phrases: 36 to 72 months

Minimal Credit score Rating: 660

Marcus by Goldman Sachs is a direct lender that not solely gives private loans but additionally financial savings accounts, investments, and bank cards.

Private loans can be found in quantities as much as $40,000, with charges beginning as little as 6.99% APR. Not solely do they cost no charges in reference to their private loans, however there are additionally no late charges.

The minimal credit score rating requirement of 660 means you will have no less than common credit score to qualify. This isn’t a lender for customers with truthful or poor credit score.

Minimal/Most Mortgage Quantity: $2,000 to $50,000

Curiosity Fee Vary: 5.99% to 35.99% APR

Charges: 0.99% to five.99%

Mortgage Phrases: 36 or 60 months

Minimal Credit score Rating: 600

Whereas Best Egg offers private loans for debt consolidation, the corporate is now increasing into providing bank cards.

Private loans can be found in quantities as much as $50,000, with rates of interest beginning as little as 5.99% APR, when it comes to 36 or 60 months. The corporate has already supplied greater than $10 billion in private loans to customers.

Finest Egg is a direct lender, with loans supplied by New Jersey-based Cross River Financial institution. Although the minimal credit score rating requirement is 600, the corporate requires a minimal particular person earnings of $100,000.

Minimal/Most Mortgage Quantity: $5,000 to $40,000

Curiosity Fee Vary: 5.99% to 24.99% APR

Charges: 0% to five%

Mortgage Phrases: 24 or 60 months

Minimal Credit score Rating: 640

Joyful Cash is a direct on-line lender offering private loans. Nonetheless, these loans can be found just for debt consolidation. They won’t be obtainable for main bills, like a marriage or an upcoming trip.

Loans can be found in quantities as much as $40,000, with charges as little as 5.99% APR. You’ll have a alternative on the mortgage time period of both 24 or 60 months. However anticipate to pay an origination charge as excessive as 5%.

Debt Consolidation Information

What Is Debt Consolidation?

In the end, debt consolidation is each a manner to get out of debt and a possibility to decrease your whole month-to-month funds.

Debt consolidation doesn’t decrease the whole quantity of current debt you owe or your total credit score utilization. As a substitute, it rolls a number of loans into one, with a single mortgage steadiness and one month-to-month cost.

Simply by consolidating a number of loans into one single installment mortgage, you could possibly profit from a decrease rate of interest or extra manageable reimbursement phrases.

That may translate right into a decrease month-to-month cost. And since debt consolidation loans are usually structured with a hard and fast charge and time period, the consolidated debt shall be totally repaid on the finish of the time period.

This may be particularly useful with high-interest debt, similar to that of bank cards, or for unsecured debt.

Essentially the most primary purpose why it’s so laborious to get out of bank card debt is due to its revolving nature. As you pay down, the month-to-month cost drops.

And once you use the cardboard for extra purchases, the steadiness will increase. That additionally raises your bank card cost.

However by paying off the bank card debt with a consolidation mortgage, the mortgage — which incorporates your bank card debt — shall be totally repaid after simply three to 5 years.

Should you ever marvel if I ought to consolidate my debt, crunch the numbers and see the way it can work together with your bank card debt.

How Do Debt Consolidation Loans Work?

Debt consolidation loans are basically unsecured loans that supply a hard and fast rate of interest and time period. The mixture makes it potential to get rid of the consolidated debt inside a really particular timeframe.

Debt consolidation loans can vary anyplace from 24 months to so long as 84 months, although it’s potential to increase that out to 144 months (12 years) via a lender like LightStream.

Debt consolidation loans are usually supplied within the type of private loans. These work particularly effectively for debt consolidation since they can be utilized for nearly any objective, from medical payments to bank card consolidation.

Whereas most normally deposit the mortgage funds into the borrower’s checking account immediately, some pay the cash out on to the lenders.

The rate of interest you’ll pay on a debt consolidation mortgage will rely upon a mixture of components, together with your credit score rating, your debt-to-income ratio, and the quantity borrowed.

Debt consolidation is among the most easy methods to enhance debt administration abilities. At a minimal, it allows you to cut back the variety of month-to-month mortgage funds. That by itself can provide you higher management over your money owed.

Does Debt Consolidation Have an effect on My Credit score Rating or Month-to-month Funds?

Sure, on each counts! Let’s take a look at credit score scores first.

One of many components credit score bureaus think about when calculating your credit score rating is the variety of loans and credit score traces with excellent balances.

If you use a debt consolidation mortgage to roll a number of money owed right into a single mortgage, the variety of excellent money owed declines instantly.

One thing else occurs as effectively, no less than once you’re consolidating bank cards. The credit score bureaus think about installment debt, which is often what debt consolidation loans are, to be much less dangerous than revolving debt.

In actual fact, revolving debt is taken into account the riskiest debt of all. By eliminating it via a debt consolidation mortgage, you’ll have one other issue working in your favor in direction of bettering a bad credit report rating and rising your total creditworthiness.

Many individuals who do debt consolidation loans expertise an instantaneous enhance of their credit score scores for the explanations described above, even regardless of the drop from the credit score inquiry your lender makes.

It can assist to know what a superb credit score rating is so you may observe any constructive modifications in your rating after taking the mortgage.

A debt consolidation mortgage also can have an effect on your month-to-month funds. If the month-to-month cost on the consolidation mortgage is decrease than the whole of the funds on the loans you’re paying off, your web month-to-month cost will drop.

What Are the Dangers Behind Debt Consolidation Loans?

Pretty much as good as a debt consolidation mortgage sounds, you will have to keep away from debt consolidation pitfalls.

Most likely the commonest is once you arrange a debt consolidation mortgage after which proceed borrowing more cash.

That’s a straightforward lure to fall into as a result of the debt consolidation mortgage can look like a get-out-of-jail-free card. However relaxation assured, it’s not. Should you proceed with this sample, you’ll find yourself with a bunch of latest debt on prime of your debt consolidation mortgage.

One other potential pitfall shouldn’t be getting full management of your finances after a debt consolidation mortgage.

You must consider a debt consolidation mortgage as a monetary instrument designed that can assist you take care of previous monetary errors, like overspending.

However if you happen to proceed to overspend, which can possible end in new debt, the debt consolidation effort shall be a failure.

Methods to Qualify for a Debt Consolidation Mortgage?

Methods to get a private mortgage accepted includes a sequence of steps. These will focus on your credit score rating, debt-to-income ratio, and the sum of money you borrow.

Many lenders will assign you a credit score grade based mostly on a mix of the three. The upper your grade, the decrease the speed you’ll pay, and vice versa.

Your debt-to-income ratio, which is solely your month-to-month recurring money owed divided by your steady month-to-month earnings, signifies how effectively the brand new mortgage will match inside your finances.

The decrease your debt ratio—say, lower than 30%—the higher your mortgage grade shall be. A excessive ratio (exceeding 40%) will point out the next threat issue, contributing to a decrease grade.

The identical is true with the mortgage quantity you borrow. A $50,000 mortgage shall be thought-about a much bigger threat to the lender than a $15,000 mortgage. Your mortgage grade could also be decrease if you happen to take a bigger mortgage quantity.

Most necessary is your credit score rating. As you may see from the lenders included on this information, a credit score rating of no less than 680 will get you a decrease rate of interest.

Beneath 680, you will note you paying on the higher finish of the rate of interest vary. For that reason, it will likely be necessary to enhance your credit score rating, even to use for a debt consolidation mortgage.

Get a replica of your credit score report and focus on fixing errors in your credit score report.

But when your credit score rating is way under 650, it could be time to look into utilizing the providers of top-of-the-line credit score restore providers. It may imply the distinction between a ten% rate of interest and 20% or 30%.

Some lenders might will let you entry a greater charge or up your potential eligibility by taking out the mortgage with a co-signer with higher credit score.

How We Discovered the Finest Debt Consolidation Loans

To provide you with this listing of the ten greatest debt consolidation loans for 2024, we used the next standards:

- The minimal and most mortgage quantities supplied

- The rate of interest vary marketed by the lender

- Any and all charges a lender might cost, together with prepayment

- penalties, origination charges, and software charges

- Minimal credit score rating necessities

Above and past these 5 components, we additionally thought-about firm repute, recognition with customers, and any particular options or further providers every gives.

Abstract of the Finest Debt Consolidation Loans

Let’s recap the ten greatest debt consolidation loans for 2024:

- LendingTree: Finest Lender Choice

- LendingClub: Finest for Peer-to-Peer Loans

- SoFi: Finest for Complete Monetary Companies

- Upstart: Finest for Truthful Credit score

- Even: Finest for Excessive Mortgage Quantities

- LightStream: Finest for Good to Wonderful Credit score

- Marcus by Goldman Sachs: Finest for Investing

- Finest Egg: Finest for Good Buyer Service

- Joyful Cash (previously Payoff): Finest for Excessive DTI Ratios

Should you’re drowning in bank card debt, a debt consolidation mortgage stands out as the proper technique for you. It’s the proper manner so that you can get off the revolving debt treadmill.