Pissed off with meager financial savings account rates of interest? You are not alone. Uncover 9 banking alternate options that provide larger yields, from neobanks to crypto financial savings accounts, and think about diversifying your cash to make it work more durable for you.

Do you know the typical bank is paying 0.43% in curiosity on their financial savings accounts? That appears loopy sufficient by itself, but it surely’s even crazier that my financial institution is paying even lower than that.

That’s proper; my very own financial institution is paying a fraction of the typical financial savings rate of interest….truly .01%. Even worse, my financial institution (U.S. Financial institution) has been paying near the identical paltry fee for years.

I feel my financial institution hates me. Are you able to relate?

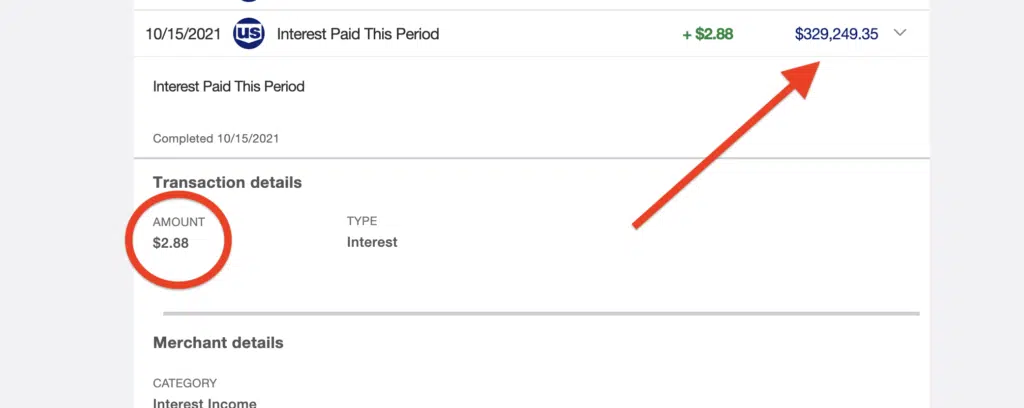

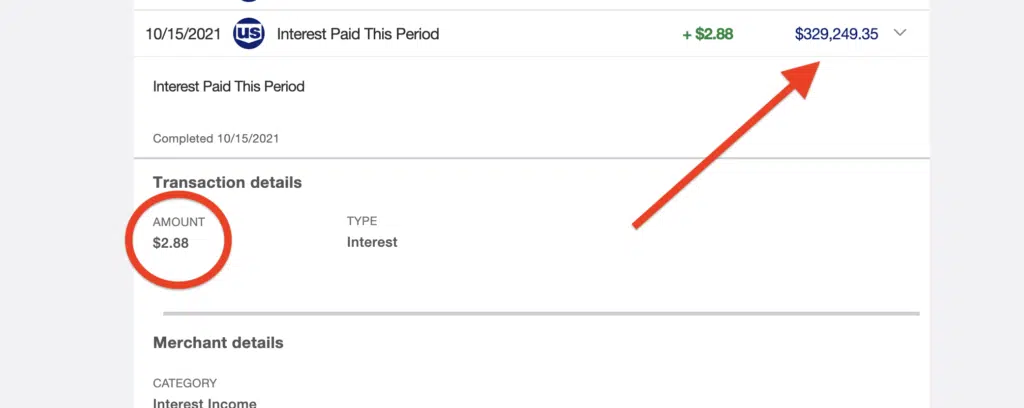

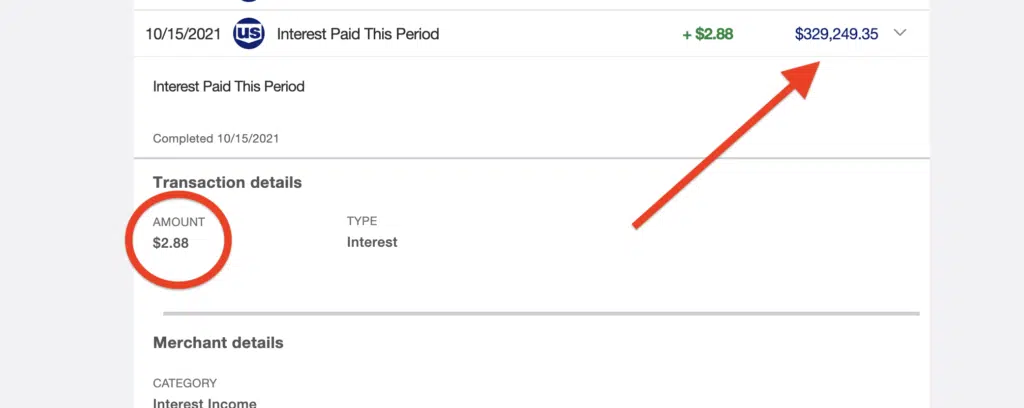

You possibly can see precisely what I imply within the screenshot under. I’ve greater than $329,000 in one among our financial savings accounts, and I solely earned $2.88 in curiosity in the course of the month I grabbed this picture.

That’s fairly unhappy when you consider it, however I do know I’m not alone. Half the folks studying this submit are most likely incomes about that a lot on their financial savings, if something in any respect.

Everyone knows that rates of interest have been hovering at or close to file lows for years, and banks can provide nearly nothing because of this.

Thankfully, we don’t should accept incomes subsequent to nothing on our financial savings accounts. In truth, there are a number of banking alternate options to earn extra in your financial savings than what a standard financial institution will provide.

One of many choices I share on this submit is paying 850X greater than the typical conventional financial institution!

Earlier than we dive into the highest banking alternate options, although, I do wish to say how necessary it’s to have an emergency fund.

It’s at all times doable you’ll lose your job or face an unpredictable monetary emergency, and your long-term financial savings may very well be the one factor that helps you keep away from every kind of monetary mayhem (you possibly can try a few of the greatest financial savings account charges right here).

For instance, you might wish to have a much bigger emergency fund if you happen to’re self-employed or you might have youngsters, whereas you may get away with a smaller e-fund if you happen to’re single, you might have actually low bills, or your job is extraordinarily safe.

Both manner, the banking alternate options I’ll dive into under will not be in your core emergency financial savings. In spite of everything, you need your e-fund in a safe account with FDIC insurance coverage. You might not earn a number of curiosity with a daily financial institution, however you gained’t lose any cash out of your financial savings, both.

Additionally, word you can try my banking alternate options podcast on Spotify if you happen to favor listening over studying. You possibly can try the podcast episodes here and here.

With that in thoughts, the banking alternate options I like to recommend are for any extra funds you might have along with your true emergency financial savings. That is cash you gained’t essentially want within the subsequent few years, so you possibly can tackle extra threat.

Which banking alternate options am I speaking about? I break down all 9 of them under.

“Neobank” is considerably of a hipster time period used to explain an online-only financial institution that doesn’t have any brick-and-mortar places. This doesn’t imply Neobanks isn’t actual; it simply means you gained’t drive round and run right into a bodily financial institution location.

And with out a bodily location to take care of, these banks have decrease overhead. This implies they will pay you extra curiosity in your financial savings.

I just lately learn that there have been greater than 300 digital banks all over the world. Among the greatest embrace SoFi, which began off as a pupil mortgage refinancing firm.

One other online-only supplier value noting is Chime, which is at the moment paying a 2.00% annual proportion yield (APY) on its financial savings accounts.

Lending Membership is yet another on-line financial institution that has been round for some time. Lending Membership was a peer-to-peer lender, however they now provide a web-based financial savings account that’s at the moment paying a 0.60% annual proportion yield.

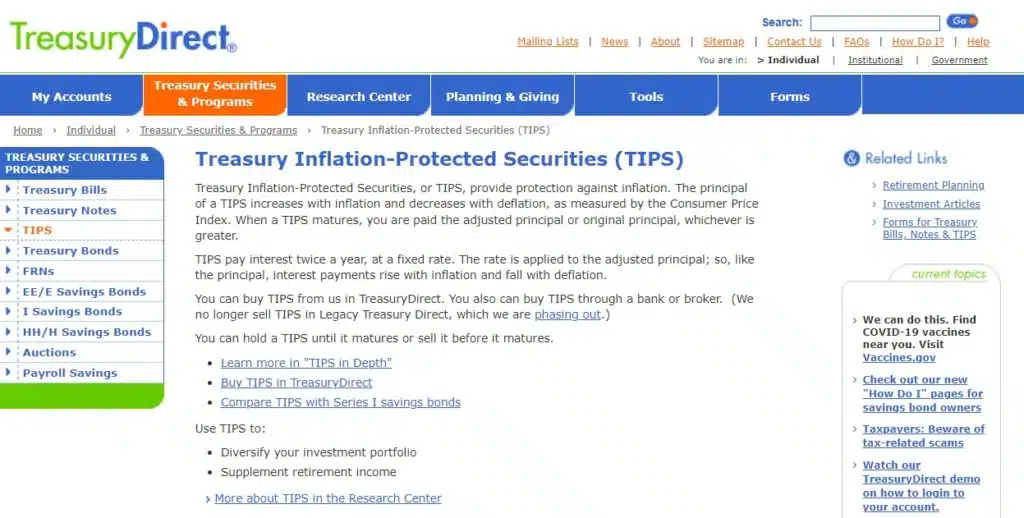

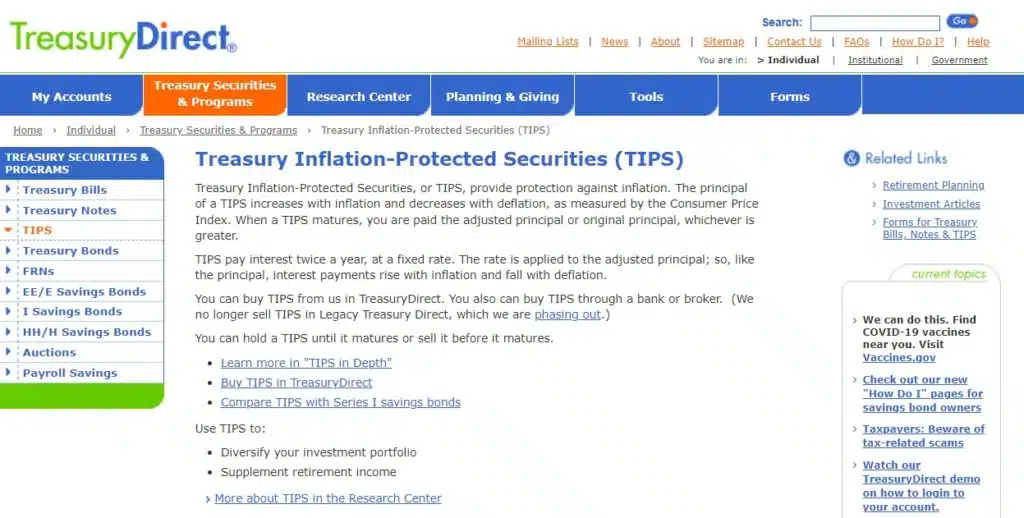

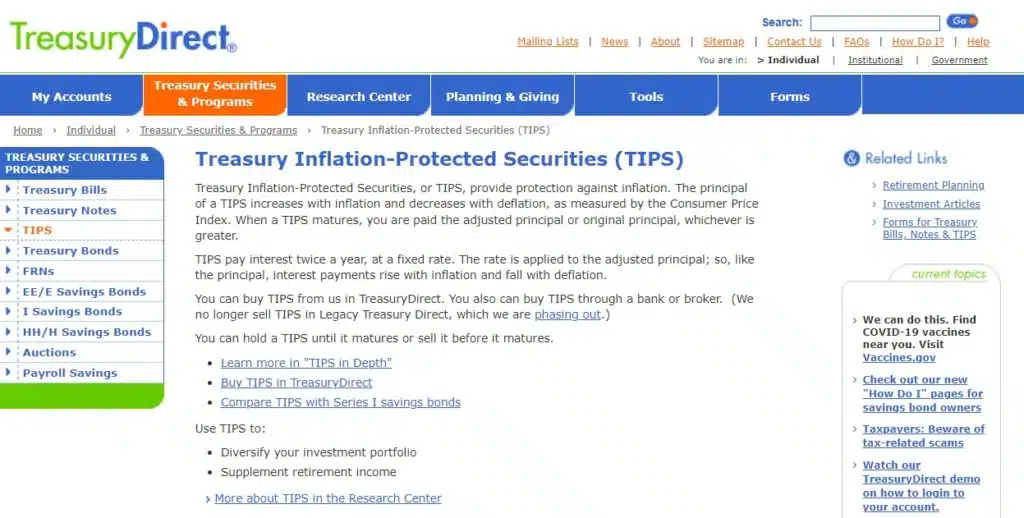

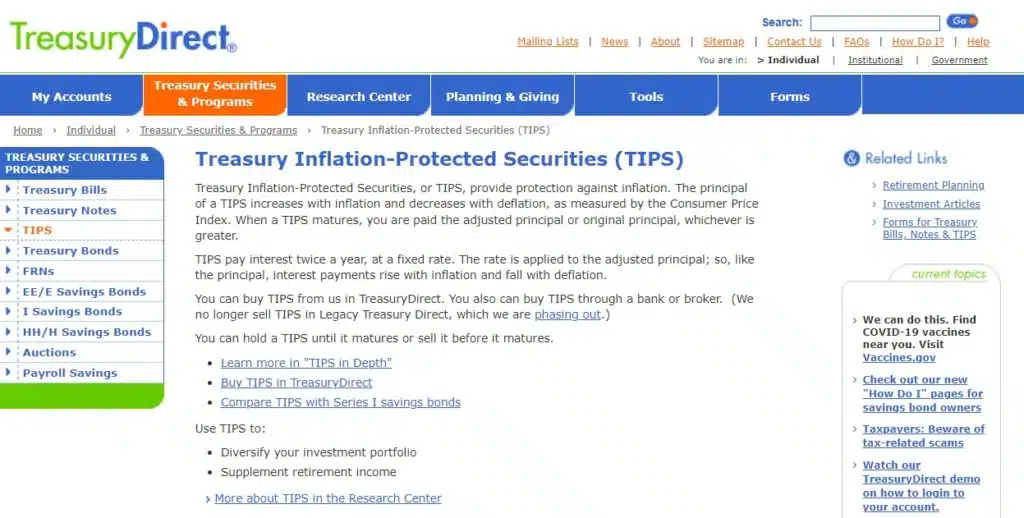

When you suppose inflation is barely going up from right here, Treasury Inflation-Protected Securities (TIPS) might present a wonderful place to stash your extra money.

TIPS robotically adjusts primarily based on the CPI Index, which is the Shopper Value Index that measures the costs of various items and providers. This makes it one other nice banking various.

Whereas some might disagree that TIPS is definitely maintaining with inflation, you possibly can go to TreasuryDirect.gov to learn extra about this funding choice and different bonds which might be issued by the federal government.

TIPS are issued in increments of $100, so it’s a must to have at the least $100 to get began investing. One other main advantage of TIPS is the actual fact you don’t should pay state or native taxes in your returns. Be aware: With TIPS, you do should pay federal taxes in your features.

On-line funding apps (a.okay.a. on-line brokerage providers) are one other nice banking various that features corporations like Robinhood and M1 Finance.

When most individuals consider these corporations, they could robotically consider meme shares or crypto investing. Nonetheless, these apps even have a money administration account that pays a good fee of return.

With Robinhood, for instance, the money administration part of the app has a financial savings part that pays 4.90% APY for gold members. Not solely that, however this account from Robinhood comes with no hidden charges.

You possibly can even use your account to get money at greater than 75,000 fee-free ATMs nationwide. Higher but, Robinhood contains FDIC Insurance coverage on its money administration accounts.

Whereas paying $125 per 12 months for a web-based account and debit card can appear actually excessive, remember the fact that you’ll earn 33X the nationwide common financial savings fee in your deposits.

Because you get 1% again on debit card purchases, you might have the potential to make up for that charge in a rush and nonetheless find yourself forward.

Most individuals consider bonds as being extraordinarily secure, and they’re. Nonetheless, folks buy bonds loads in a different way than they did a number of a long time in the past.

The child boomer era went out and bought particular person bonds straight from the issuer, whether or not they have been municipal bonds or one thing else. Nonetheless, a lot of at present’s traders buy their bonds by means of mutual funds or ETFs.

One instance of a mutual fund with high-yield bonds is the American Century Excessive-Revenue Yield Fund (NPHIX). The present yield on this fund is 6.38%, though this fund has extra threat. This implies it’s possible your steadiness will go up and down over time.

One other instance is the Nuveen Excessive Yield Municipal Bond Fund (NHMRX), which comes with a yield of 5.65%. As soon as once more, it is a high-yield bond with larger threat, so you might have the potential to see your steadiness fluctuate over the long run.

There are additionally fairly a couple of ETFs with high-yield bonds, together with the SPDR Excessive-Yield Bond ETF (JNK), with a yield of 5.65%. This sort of bond is taken into account a junk bond, so the JNK image on this one is definitely kinda humorous.

When you’re questioning the place to purchase high-yield bonds, you gained’t should look far.

You possibly can spend money on high-yield bonds by means of all of the common on-line brokerage corporations and apps, resembling M1 Finance, Robinhood, and E*TRADE. These might all be nice various banking alternate options for extra funds.

In terms of high-yield shares, they’re structured so that they should pay out a good dividend, making them an ideal various to conventional banking.

Among the dividends on these shares provide you with a return that’s a lot larger than you’re incomes at your financial institution, though there may be extra threat concerned as nicely.

For probably the most half, I’m speaking about shares which might be listed throughout the Dividend Aristocrats. It is a record of 65 dividend shares which might be listed within the S&P 500 with a historical past of accelerating their dividend during the last 25 years.

This largely contains extra established, blue-chip-type corporations which have a protracted historical past of making returns.

For instance, AT&T is part of this group with a dividend yield of seven.79%. One other one is McDonald’s, which at the moment has a dividend yield of two.11%. Verizon can also be included, with a dividend yield of 4.79%.

The sixth banking various I wish to discuss is having a blended portfolio that features a few of the choices above.

For instance, you possibly can take a few of your extra financial savings and spend money on high-yield shares, then throw one other portion of your funds into high-yield bonds.

This technique is simple if you have already got an account with a platform like Robinhood or M1 Finance. As soon as your money administration account is open and also you get accustomed to utilizing these apps, you can begin branching off into different forms of investments with ease.

Nonetheless, M1 Finance gives funding “pies” which might be expertly crafted to go well with several types of traders primarily based on how a lot threat they wish to take.

Betterment is one other on-line platform that makes it straightforward to tailor your funding portfolio to your timeline and objectives.

Nonetheless, this firm is a robo-advisor that makes use of expertise that can assist you choose investments in your portfolio. For that purpose, Betterment is best for individuals who need entry to funding administration providers they will’t get with a daily investing app.

No matter platform you resolve to make use of, a blended method may help you earn the next fee of return in your financial savings with out “betting the farm” on one particular technique.

Whereas some particular person shares are categorized as REITs, that’s not likely what I’m speaking about right here. As an alternative, I’m speaking about choices that allow you to get publicity to actual property with the promise of a pleasant yield.

The primary choice I wish to discuss is definitely an ETF. The iShares US Real Estate ETF (IYR) has returned 6.17% during the last ten years with a dividend yield of two.94%.

That’s not half dangerous in any respect, particularly when you think about that you just by no means should set foot into the buildings you’re investing in.

And actually, that’s the foremost advantage of investing in actual property ETFs. You get publicity to the actual property market with out having to hunt for properties or take care of the grunt work of being a landlord.

You might be placing your cash in danger, however you might have the potential to attain a a lot larger return.

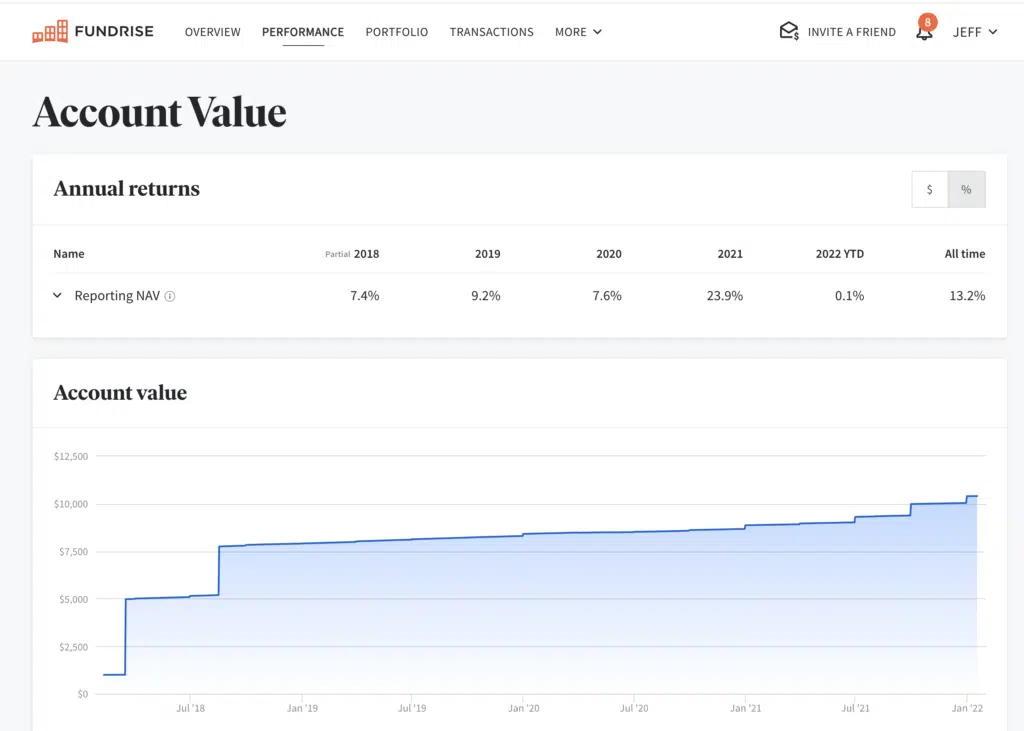

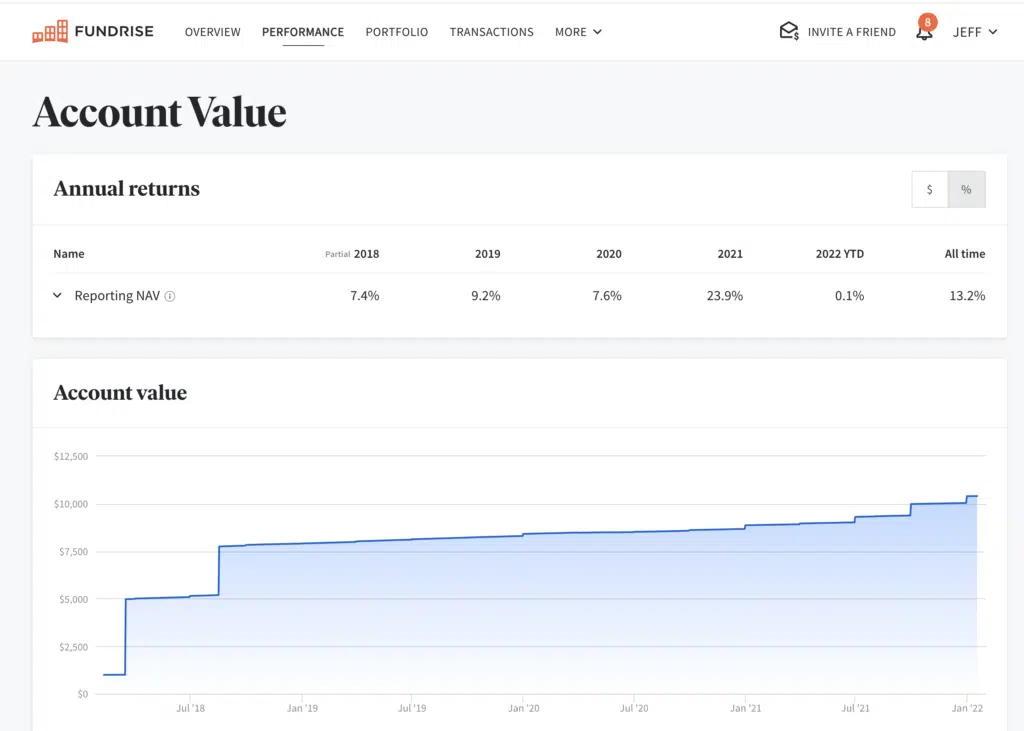

Another choice I really like and use myself is known as Fundrise. With this on-line actual property platform, you get to take a position straight right into a REIT with out coping with the middlemen fees concerned in ETFs.

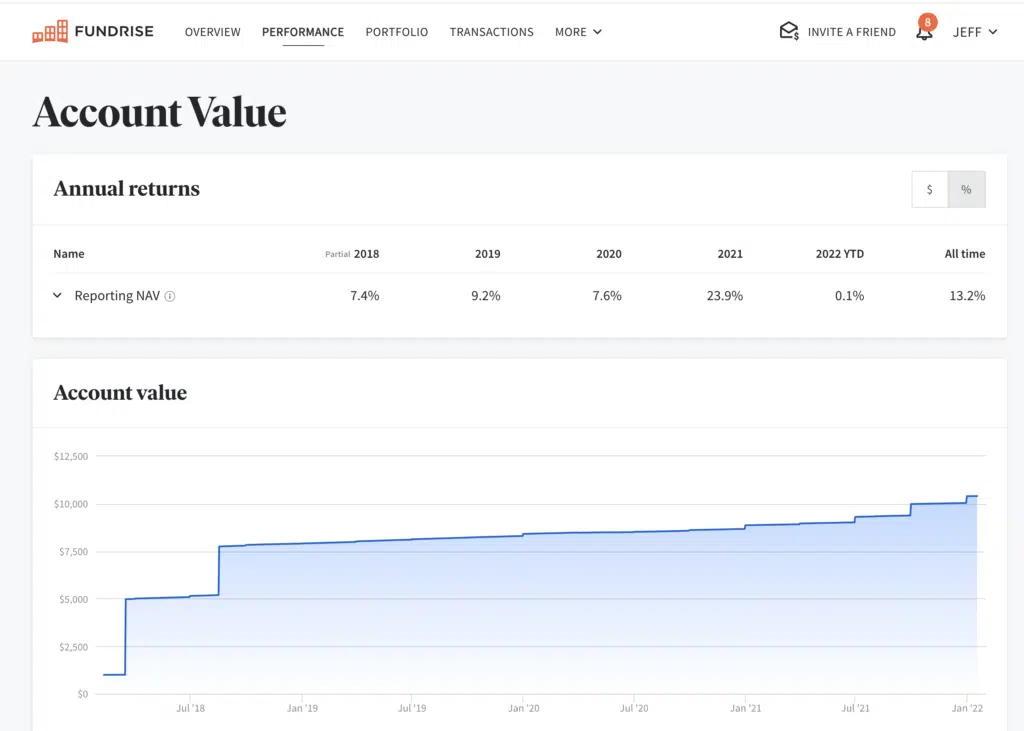

I began investing in Fundrise again in 2018, so I’ve had my account for a number of years now. Loopy sufficient, my present all-time return is 13.2%, which you’ll be able to see within the screenshot under.

One other cool factor about Fundrise is the actual fact you don’t should have an enormous amount of money to get began. The minimal funding with Fundrise begins at simply $10, and their primary starter degree is simply $1,000.

This implies you can begin investing in actual property with a fraction of the money you would wish to spend money on bodily property.

Higher but, Fundrise makes it straightforward to get a deal with on the precise properties you’re investing in, whether or not that features a mall, an condo constructing, or some kind of industrial rental property.

When you’re contemplating this selection, ensure to learn my Fundrise assessment.

To benefit from banking various #8, you could be an accredited investor.

This implies you could make $200,000 per 12 months by yourself or $300,000 along with your partner, and also you want a web value of greater than $1 million {dollars}, not counting the worth of your major residence.

When you meet these standards, carry on studying about Brief-Time period Notes and the way they work. If not, be happy to maneuver on to banking various #9!

Both manner, short-term notes are supplied by means of corporations like YieldStreet. With a short-term word from this on-line platform, you possibly can earn 40X the nationwide common cash market yield or an annualized yield of 4%.

These notes come freed from charges and bills, they usually’re a short-term product with liquidity supplied in as little as six months. Brief-term notes from this firm additionally pay month-to-month curiosity funds on to your YieldStreet pockets.

Whereas these investments are focused at accredited traders with massive portfolios, the minimal funding quantity within the YieldStreet Brief Time period Be aware Sequence XLIV is simply $500. Which means you may get began with a comparatively small quantity after which see the way it goes from there.

Lastly, let’s discuss become profitable on crypto you might have with out truly promoting it. Crypto financial savings accounts pay you a yield in your crypto deposits similar to you earn curiosity on a daily financial savings account.

I heard about this from one other investor a number of years in the past, and it nearly appeared too good to be true.

Along with different crypto platforms, I’ve an account with an organization referred to as Celsius, which I opened upon advice from a good friend.

I at the moment have slightly below $200,000 in my account from Celsius, which is paying a yield of 8.5%. Apparently, Celsius pays out their curiosity weekly as an alternative of month-to-month like different exchanges.

Simply remember the fact that investing in crypto and being profitable from crypto requires a ton of threat. There isn’t a FDIC insurance coverage, and there aren’t any ensures you gained’t lose your complete funding.

Be aware: On July 13, 2022, Celsius Community and sure of its associates filed for voluntary Chapter 11 bankruptcy.

I hope this record of banking alternate options has you serious about your cash and make it develop. In spite of everything, it’s solely pure to wish to earn the next return in your financial savings, whether or not we’re speaking about your emergency fund or different money you might have stashed away for the long run.

With that being stated, it’s essential to keep in mind that larger yields at all times equal the next degree of threat. Options to conventional banks might give you extra curiosity in your deposits, however you’re giving up some safety alongside the best way.

Do you know the typical bank is paying 0.43% in curiosity on their financial savings accounts? That appears loopy sufficient by itself, but it surely’s even crazier that my financial institution is paying even lower than that.

That’s proper; my very own financial institution is paying a fraction of the typical financial savings rate of interest….truly .01%. Even worse, my financial institution (U.S. Financial institution) has been paying near the identical paltry fee for years.

I feel my financial institution hates me. Are you able to relate?

You possibly can see precisely what I imply within the screenshot under. I’ve greater than $329,000 in one among our financial savings accounts, and I solely earned $2.88 in curiosity in the course of the month I grabbed this picture.

That’s fairly unhappy when you consider it, however I do know I’m not alone. Half the folks studying this submit are most likely incomes about that a lot on their financial savings, if something in any respect.

Everyone knows that rates of interest have been hovering at or close to file lows for years, and banks can provide nearly nothing because of this.

Thankfully, we don’t should accept incomes subsequent to nothing on our financial savings accounts. In truth, there are a number of banking alternate options to earn extra in your financial savings than what a standard financial institution will provide.

One of many choices I share on this submit is paying 850X greater than the typical conventional financial institution!

Earlier than we dive into the highest banking alternate options, although, I do wish to say how necessary it’s to have an emergency fund.

It’s at all times doable you’ll lose your job or face an unpredictable monetary emergency, and your long-term financial savings may very well be the one factor that helps you keep away from every kind of monetary mayhem (you possibly can try a few of the greatest financial savings account charges right here).

Some specialists say it is best to have three to 6 months of bills stashed away in emergency financial savings, and I are likely to agree. Nonetheless, I feel you could tailor the dimensions of your emergency fund to your distinctive scenario and wishes.

For instance, you might wish to have a much bigger emergency fund if you happen to’re self-employed or you might have youngsters, whereas you may get away with a smaller e-fund if you happen to’re single, you might have actually low bills, or your job is extraordinarily safe.

Both manner, the banking alternate options I’ll dive into under will not be in your core emergency financial savings. In spite of everything, you need your e-fund in a safe account with FDIC insurance coverage. You might not earn a number of curiosity with a daily financial institution, however you gained’t lose any cash out of your financial savings, both.

Additionally, word you can try my banking alternate options podcast on Spotify if you happen to favor listening over studying. You possibly can try the podcast episodes here and here.

9 Banking Options to Earn Extra Curiosity

With that in thoughts, the banking alternate options I like to recommend are for any extra funds you might have along with your true emergency financial savings. That is cash you gained’t essentially want within the subsequent few years, so you possibly can tackle extra threat.

Which banking alternate options am I speaking about? I break down all 9 of them under.

#1: Neobank

“Neobank” is considerably of a hipster time period used to explain an online-only financial institution that doesn’t have any brick-and-mortar places. This doesn’t imply Neobanks isn’t actual; it simply means you gained’t drive round and run right into a bodily financial institution location.

And with out a bodily location to take care of, these banks have decrease overhead. This implies they will pay you extra curiosity in your financial savings.

I just lately learn that there have been greater than 300 digital banks all over the world. Among the greatest embrace SoFi, which began off as a pupil mortgage refinancing firm.

One other online-only supplier value noting is Chime, which is at the moment paying a 2.00% annual proportion yield (APY) on its financial savings accounts.

Lending Membership is yet another on-line financial institution that has been round for some time. Lending Membership was a peer-to-peer lender, however they now provide a web-based financial savings account that’s at the moment paying a 0.60% annual proportion yield.

#2: Treasury Inflation-Protected Securities (TIPS)

When you suppose inflation is barely going up from right here, Treasury Inflation-Protected Securities (TIPS) might present a wonderful place to stash your extra money.

TIPS robotically adjusts primarily based on the CPI Index, which is the Shopper Value Index that measures the costs of various items and providers. This makes it one other nice banking various.

Whereas some might disagree that TIPS is definitely maintaining with inflation, you possibly can go to TreasuryDirect.gov to learn extra about this funding choice and different bonds which might be issued by the federal government.

TIPS are issued in increments of $100, so it’s a must to have at the least $100 to get began investing. One other main advantage of TIPS is the actual fact you don’t should pay state or native taxes in your returns. Be aware: With TIPS, you do should pay federal taxes in your features.

#3: On-line Funding Apps

On-line funding apps (a.okay.a. on-line brokerage providers) are one other nice banking various that features corporations like Robinhood and M1 Finance.

When most individuals consider these corporations, they could robotically consider meme shares or crypto investing. Nonetheless, these apps even have a money administration account that pays a good fee of return.

With Robinhood, for instance, the money administration part of the app has a financial savings part that pays 4.90% APY for gold members. Not solely that, however this account from Robinhood comes with no hidden charges.

You possibly can even use your account to get money at greater than 75,000 fee-free ATMs nationwide. Higher but, Robinhood contains FDIC Insurance coverage on its money administration accounts.

M1 Finance additionally boasts its personal finance “tremendous app” that can truly set you again $125 per 12 months. Nonetheless, this account pays a 1% rate of interest, and also you get a debit card that pays 1% cashback every time you utilize it.

Whereas paying $125 per 12 months for a web-based account and debit card can appear actually excessive, remember the fact that you’ll earn 33X the nationwide common financial savings fee in your deposits.

Because you get 1% again on debit card purchases, you might have the potential to make up for that charge in a rush and nonetheless find yourself forward.

#4: Excessive-Yield Bonds

Most individuals consider bonds as being extraordinarily secure, and they’re. Nonetheless, folks buy bonds loads in a different way than they did a number of a long time in the past.

The child boomer era went out and bought particular person bonds straight from the issuer, whether or not they have been municipal bonds or one thing else. Nonetheless, a lot of at present’s traders buy their bonds by means of mutual funds or ETFs.

One instance of a mutual fund with high-yield bonds is the American Century Excessive-Revenue Yield Fund (NPHIX). The present yield on this fund is 6.38%, though this fund has extra threat. This implies it’s possible your steadiness will go up and down over time.

One other instance is the Nuveen Excessive Yield Municipal Bond Fund (NHMRX), which comes with a yield of 5.65%. As soon as once more, it is a high-yield bond with larger threat, so you might have the potential to see your steadiness fluctuate over the long run.

There are additionally fairly a couple of ETFs with high-yield bonds, together with the SPDR Excessive-Yield Bond ETF (JNK), with a yield of 5.65%. This sort of bond is taken into account a junk bond, so the JNK image on this one is definitely kinda humorous.

When you’re questioning the place to purchase high-yield bonds, you gained’t should look far.

You possibly can spend money on high-yield bonds by means of all of the common on-line brokerage corporations and apps, resembling M1 Finance, Robinhood, and E*TRADE. These might all be nice various banking alternate options for extra funds.

#5: Excessive-Yield Shares

In terms of high-yield shares, they’re structured so that they should pay out a good dividend, making them an ideal various to conventional banking.

Among the dividends on these shares provide you with a return that’s a lot larger than you’re incomes at your financial institution, though there may be extra threat concerned as nicely.

For probably the most half, I’m speaking about shares which might be listed throughout the Dividend Aristocrats. It is a record of 65 dividend shares which might be listed within the S&P 500 with a historical past of accelerating their dividend during the last 25 years.

This largely contains extra established, blue-chip-type corporations which have a protracted historical past of making returns.

For instance, AT&T is part of this group with a dividend yield of seven.79%. One other one is McDonald’s, which at the moment has a dividend yield of two.11%. Verizon can also be included, with a dividend yield of 4.79%.

#6: Blended Portfolio

The sixth banking various I wish to discuss is having a blended portfolio that features a few of the choices above.

For instance, you possibly can take a few of your extra financial savings and spend money on high-yield shares, then throw one other portion of your funds into high-yield bonds.

This technique is simple if you have already got an account with a platform like Robinhood or M1 Finance. As soon as your money administration account is open and also you get accustomed to utilizing these apps, you can begin branching off into different forms of investments with ease.

Simply take note how some apps can work higher for making a blended portfolio. With Robinhood, for instance, you would need to select your individual funds and rebalance them over time.

Nonetheless, M1 Finance gives funding “pies” which might be expertly crafted to go well with several types of traders primarily based on how a lot threat they wish to take.

Betterment is one other on-line platform that makes it straightforward to tailor your funding portfolio to your timeline and objectives.

Nonetheless, this firm is a robo-advisor that makes use of expertise that can assist you choose investments in your portfolio. For that purpose, Betterment is best for individuals who need entry to funding administration providers they will’t get with a daily investing app.

No matter platform you resolve to make use of, a blended method may help you earn the next fee of return in your financial savings with out “betting the farm” on one particular technique.

#7: Actual Property Funding Trusts (REITs)

Whereas some particular person shares are categorized as REITs, that’s not likely what I’m speaking about right here. As an alternative, I’m speaking about choices that allow you to get publicity to actual property with the promise of a pleasant yield.

The primary choice I wish to discuss is definitely an ETF. The iShares US Real Estate ETF (IYR) has returned 6.17% during the last ten years with a dividend yield of two.94%.

That’s not half dangerous in any respect, particularly when you think about that you just by no means should set foot into the buildings you’re investing in.

And actually, that’s the foremost advantage of investing in actual property ETFs. You get publicity to the actual property market with out having to hunt for properties or take care of the grunt work of being a landlord.

You might be placing your cash in danger, however you might have the potential to attain a a lot larger return.

Another choice I really like and use myself is known as Fundrise. With this on-line actual property platform, you get to take a position straight right into a REIT with out coping with the middlemen fees concerned in ETFs.

I began investing in Fundrise again in 2018, so I’ve had my account for a number of years now. Loopy sufficient, my present all-time return is 13.2%, which you’ll be able to see within the screenshot under.

One other cool factor about Fundrise is the actual fact you don’t should have an enormous amount of money to get began. The minimal funding with Fundrise begins at simply $10, and their primary starter degree is simply $1,000.

This implies you can begin investing in actual property with a fraction of the money you would wish to spend money on bodily property.

Higher but, Fundrise makes it straightforward to get a deal with on the precise properties you’re investing in, whether or not that features a mall, an condo constructing, or some kind of industrial rental property.

When you’re contemplating this selection, ensure to learn my Fundrise assessment.

#8: Brief-Time period Be aware

To benefit from banking various #8, you could be an accredited investor.

This implies you could make $200,000 per 12 months by yourself or $300,000 along with your partner, and also you want a web value of greater than $1 million {dollars}, not counting the worth of your major residence.

When you meet these standards, carry on studying about Brief-Time period Notes and the way they work. If not, be happy to maneuver on to banking various #9!

Both manner, short-term notes are supplied by means of corporations like YieldStreet. With a short-term word from this on-line platform, you possibly can earn 40X the nationwide common cash market yield or an annualized yield of 4%.

These notes come freed from charges and bills, they usually’re a short-term product with liquidity supplied in as little as six months. Brief-term notes from this firm additionally pay month-to-month curiosity funds on to your YieldStreet pockets.

Whereas these investments are focused at accredited traders with massive portfolios, the minimal funding quantity within the YieldStreet Brief Time period Be aware Sequence XLIV is simply $500. Which means you may get began with a comparatively small quantity after which see the way it goes from there.

#9: Crypto Financial savings Accounts

Lastly, let’s discuss become profitable on crypto you might have with out truly promoting it. Crypto financial savings accounts pay you a yield in your crypto deposits similar to you earn curiosity on a daily financial savings account.

I heard about this from one other investor a number of years in the past, and it nearly appeared too good to be true.

Along with different crypto platforms, I’ve an account with an organization referred to as Celsius, which I opened upon advice from a good friend.

I at the moment have slightly below $200,000 in my account from Celsius, which is paying a yield of 8.5%. Apparently, Celsius pays out their curiosity weekly as an alternative of month-to-month like different exchanges.

Simply remember the fact that investing in crypto and being profitable from crypto requires a ton of threat. There isn’t a FDIC insurance coverage, and there aren’t any ensures you gained’t lose your complete funding.

Be aware: On July 13, 2022, Celsius Community and sure of its associates filed for voluntary Chapter 11 bankruptcy.

The Backside Line: 9 Greater-Paying Banking Options to Ditch Your Financial institution

I hope this record of banking alternate options has you serious about your cash and make it develop. In spite of everything, it’s solely pure to wish to earn the next return in your financial savings, whether or not we’re speaking about your emergency fund or different money you might have stashed away for the long run.

With that being stated, it’s essential to keep in mind that larger yields at all times equal the next degree of threat. Options to conventional banks might give you extra curiosity in your deposits, however you’re giving up some safety alongside the best way.